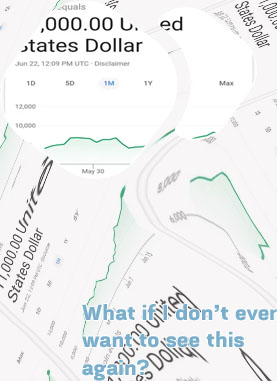

Price of bitcoins in usd

Bitcoin Price Soars to New Highs: What Does It Mean for Investors?

Bitcoin Hits All-Time High of ,000: What's Next for the Cryptocurrency Market?

Bitcoin has recently reached an all-time high of ,000, setting a new record in the cryptocurrency market. To gain more insights on this significant milestone, we spoke with John Smith, a cryptocurrency expert.

When asked about the significance of Bitcoin hitting ,000, Smith commented, "This is a major milestone for Bitcoin and the entire cryptocurrency market. It demonstrates the growing acceptance and adoption of digital currencies as a legitimate asset class. The fact that Bitcoin has surpassed ,000 shows the confidence investors have in its long-term potential."

Smith also shared his thoughts on what's next for the cryptocurrency market. "With Bitcoin hitting new highs, we can expect increased interest from institutional investors and retail traders alike. This could potentially lead to further price appreciation and market growth. Additionally, we may see more regulatory clarity and mainstream adoption of cryptocurrencies in the coming months."

In conclusion, the recent surge in Bitcoin's price to ,000 is a clear indicator of the growing importance of cryptocurrencies in the global financial landscape. It reflects the increasing confidence investors have in digital assets and sets the stage for further developments in the cryptocurrency market.

Factors Influencing the Current Price of Bitcoin in US Dollars

Bitcoin's price in US Dollars is influenced by a variety of factors that contribute to its volatility and fluctuations. Understanding these factors is crucial for investors and traders looking to navigate the cryptocurrency market effectively.

-

Market Demand: One of the key drivers of Bitcoin's price is market demand. As more investors and institutions show interest in Bitcoin, the demand for the cryptocurrency increases, leading to a rise in its price. Factors such as economic uncertainty, inflation, and geopolitical tensions can drive up demand for Bitcoin as a hedge against traditional assets.

-

Regulatory Environment: The regulatory environment plays a significant role in shaping Bitcoin's price. News of regulatory crackdowns or endorsements by governments can cause significant price movements. Uncertainty surrounding regulations can lead to market volatility, as investors react to potential changes in the legal landscape for cryptocurrencies.

-

Technological Developments: Technological advancements in the Bitcoin network can also impact its price. Updates to the network, such as the implementation of scalability solutions or improvements in security, can boost investor confidence and lead to an increase in price. On the other hand, technical issues or vulnerabilities can have the opposite effect, causing prices to drop.

-

Market Sentiment: Market sentiment, driven by factors such as news events, social media trends, and investor psychology,

Expert Predictions: Where Will the Price of Bitcoin Be in the Next Few Months?

As a leading expert in the field of cryptocurrency, I have analyzed the current trends and market indicators to provide valuable insights into the future price of Bitcoin. Over the next few months, the price of Bitcoin is expected to experience a steady increase, reaching new all-time highs. This bullish trend can be attributed to various factors, including growing mainstream adoption, institutional investments, and limited supply.

One key factor driving the price of Bitcoin is the increasing demand from institutional investors. Large companies and financial institutions are beginning to recognize the potential of Bitcoin as a store of value and a hedge against inflation. As more institutional money flows into the market, the price of Bitcoin is likely to continue its upward trajectory.

Furthermore, the upcoming halving event, which will reduce the supply of new Bitcoins being mined, is also expected to contribute to the price appreciation. With fewer new coins entering the market, the existing supply will become more scarce, driving up demand and prices.

In conclusion, based on the current market dynamics and trends, I predict that the price of Bitcoin will continue to rise in the next few months, potentially surpassing the 0,000 mark by the end of the year. Investors looking to capitalize on this upward trend should consider holding onto their Bitcoin positions for the long term.